Camelot trading competition: the fun continues!

We are excited to unveil our latest trading contest on the Arbitrum One mainnet with ARB rewards paid out shortly after the contest ends. Marginly is collaborating with Camelot, a prominent DEX within the Arbitrum ecosystem. This partnership signifies our dedication to Arbitrum and empowering Marginly and its traders by connecting to all major liquidity sources within the ecosystem.

Contest timeline

Registration: March 6th - March 13th

Contest: March 13th - March 27th

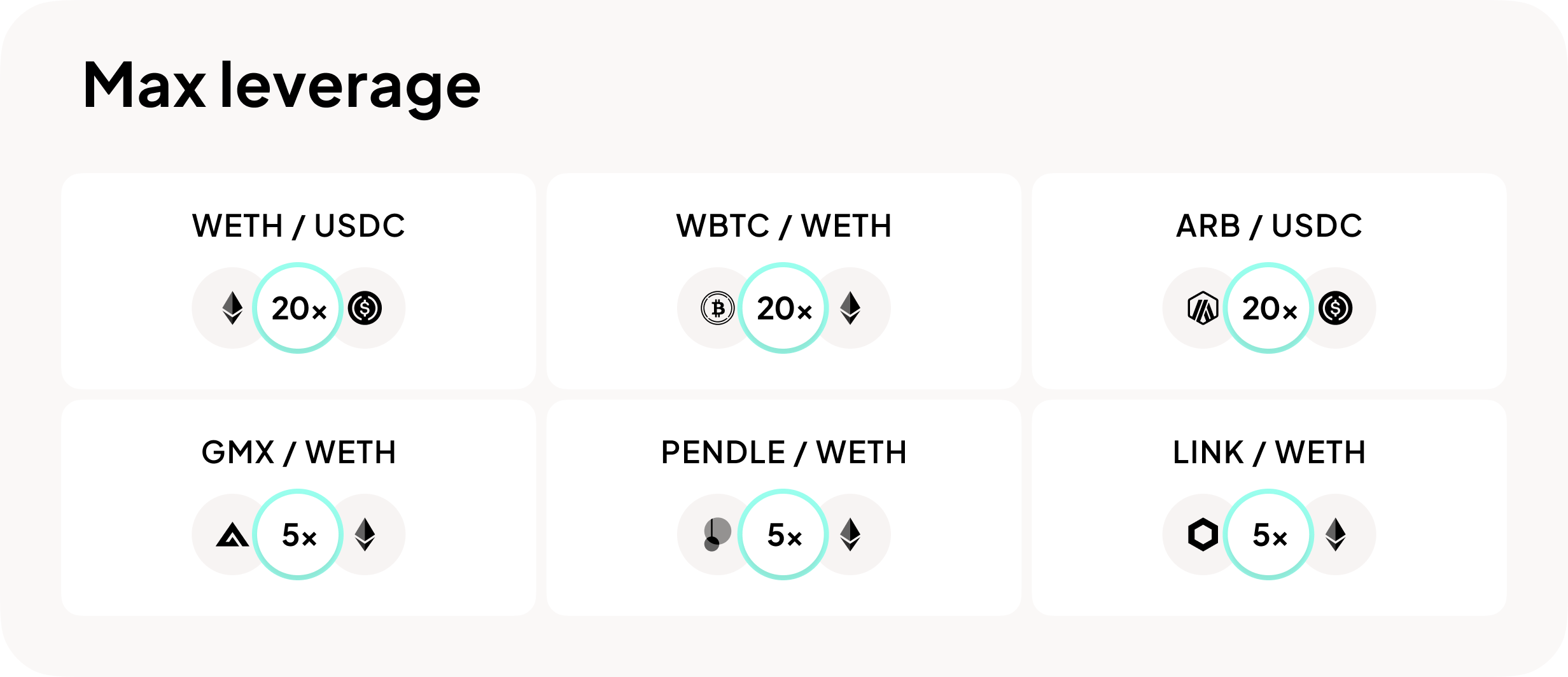

Pools

Prizes

$6,5k total prize pool comprised entirely of ARB tokens!

Traders will be ranked based on relative PnL (measured in %). A live leaderboard will be available 24/7 to track traders’ progress.

Referral prizes

The good old referral competition is back! Here’s the prizes, in ARB tokens:

How to register

- Visit the official registration form

- Click “Register” (leave your email as well if you’d like to be in the know about future events)

- Connect your wallet

- Receive confirmation on the success screen

- Copy your referral code from the success screen (optional)

That’s it, you’re in!

Rules

- Participants are required to engage in trades with a minimum margin size of $100.

- Trades must be opened and closed within the competition date range.

PnL calculation

Winners will be determined through a leaderboard tracking the cumulative percentage PnL (Profit and Loss) for each trader. The cumulative Percentage PnL is calculated as the total of trade percentage PnLs.

Notably, a trade is not defined as a single transaction but rather as a period between zero debt balances, thereby presenting a distinctive approach to assessing trading performance. For example, if you close your first trade with a Percentage PnL of 20% and close your second trade with a Percentage PnL of -5%, your Cumulative Percentage PnL would be 15%. This determination seeks to capture the comprehensive aspect of trading actions, presenting a more holistic perspective on participants’ performance throughout the competition.

Let’s consider a series of trader actions:

- Bring 1 ETH

- Buy 2 ETH on margin (2000 USDC debt)

- Deposit 1 ETH collateral

- Pay off 1000 USDC debt

- Withdraw 1 ETH collateral

- Buy 1 more ETH

- Pay off the entire debt (close position)

All of these will be considered as one action for the purposes of PnL calculation. The PnL in this case will be the sum of all percentages on every action.

Let the trading contest begin, and may the best traders emerge victorious!