Marginly’s Guide to Leveraged Yield Farming Through Pendle Finance

What is Leveraged Yield Farming?

We’ve previously discussed the benefits of leveraged farming with Marginly. For a deeper understanding please refer to our blog post where we compare various protocols in this field and provide a detailed overview of the process.

Here's a quick recap of how the all works:

- The Pendle protocol allows the splitting of LRTs (which are inherently yield-bearing tokens) into a yield component (known as YT tokens) and a principal component (known as PT tokens) for any LRT.

- PT tokens are a great tool to lock in yield until maturity, as they convert to the underlying asset at 1:1 ratio upon maturity.

- You can think of PT tokens as Zero Coupon Bonds, which should make it an easier concept to understand.

Marginly allows you to borrow an LRT and purchase PT tokens with up to 20x leverage, effectively increasing your returns 20-fold. However, there are some important caveats to be had.

Let’s dive into a more detailed example of the farming example, complete with calculations.

4-Step Farming Guide

Step 1

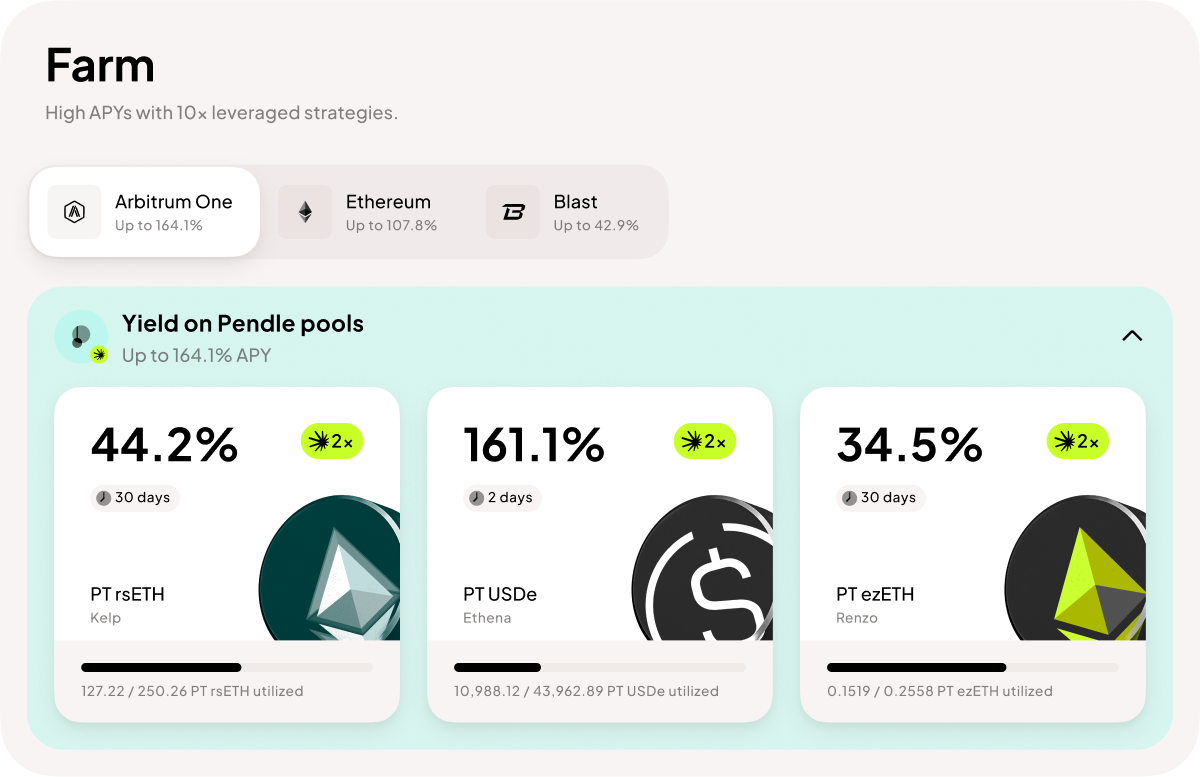

Go to Marginly’s farming page (for this example, we’re using Arbitrum L) and choose a pool you’d like to farm. You should see the following list:

Step 2

Select your desired pool and click on it. A pop-up window should appear:

Enter the amount of ETH and select your desired interest rate (2x, 5x and 10x leverage). Alternatively, you can use Pendle PT tokens or a corresponding LRT (in this case, ezETH) as collateral. If you choose this option, the swap to the corresponding PT token collateral will happen via the Pendle router.

Step 3

You can view the details of the position you’re about to open:

Most of the fields are self-explanatory, but if you have any questions or issues, please reach out to us on Discord, where we can promptly assist you!

Step 4

Once you’re ready, click the “Farm” button at the bottom of the pop-up! Depending on your input, you may first be prompted to complete the swap, and then approve the spending of your PT tokens, after which you’ll obtain your leveraged position!

Voila! You’re now a happy leveraged yield farmer on Pendle!

Farming Risks

Sorry to interrupt, fellow degen, but we do need to talk about the risks involved when using leverage.

- Market Risks: If PT tokens decrease in price relative to the underlying LRT, you may get liquidated. As a general rule, the price movement required to trigger liquidation is proportional to the leverage of your position. For example, with 10x leverage, a 10% drop in PT price could ruin you. In reality, it's even less, as Marginly’s liquidation threshold is around 5% (20x leverage). If you’re curious and don’t mind some middle-school math, check out this excellent blog post that explains spot leverage in DeFi in greater detail!

- Always check slippage and Pendle pool liquidity. Leveraging 10x and trying to get 100 PT tokens from a pool with only 100 PT tokens left isn’t a good idea, as you’ll significantly move the price against yourself.

- For best results, farm until maturity to lock in the yield offered by Pendle PT tokens. Remember, farming by borrowing ETH instead of the LRT introduces additional risks related to LRT price vs ETH price fluctuations.