Marginly is Transforming Leveraged Yield Farming

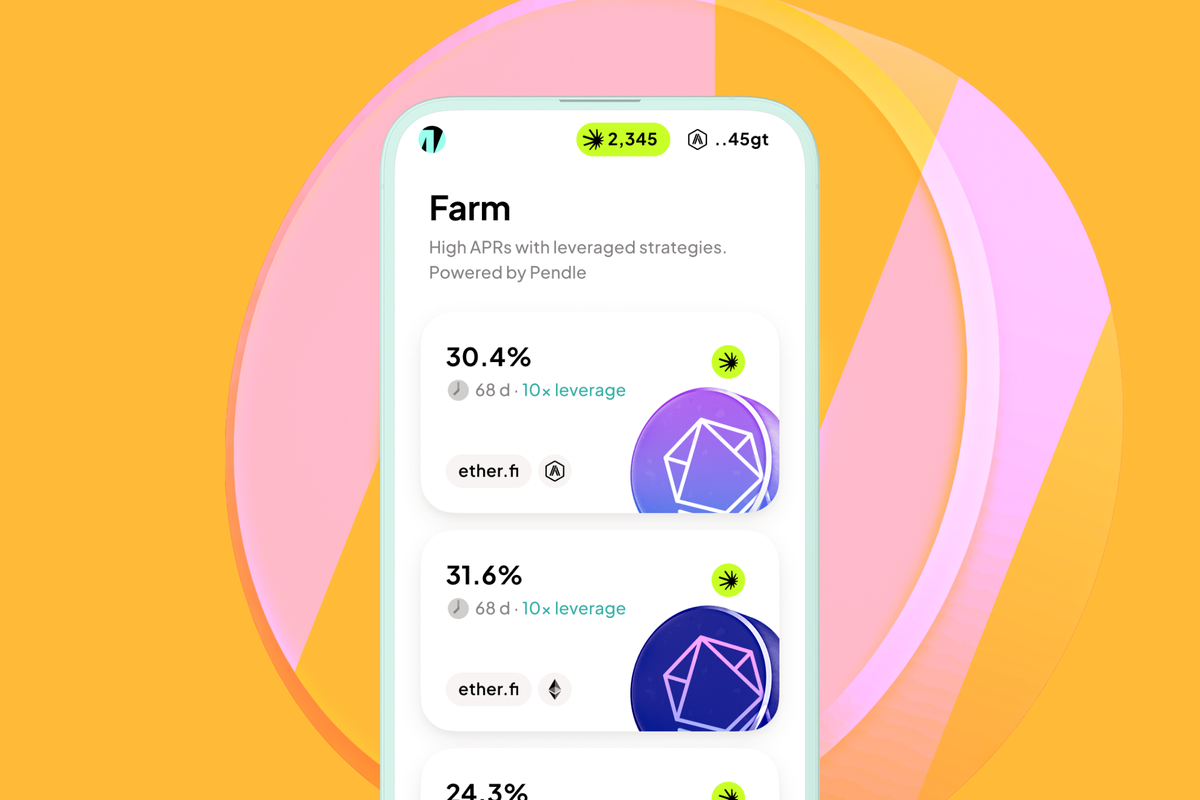

What if you could earn on yield-bearing assets — but with leverage? Marginly enables that. With smart protocol design, we’re putting up 3-figure APYs. Yes!

Marginly is starting by supporting leveraged trades on Pendle, the platform that lets you farm the yields of supported yield-bearing tokens. And we’re expanding to other yield farming protocols because Marginly is diverse like that.

What is leveraged yield farming?

The straight definition of leveraged yield farming—the practice of borrowing funds to boost your returns on yield farming. Using borrowed funds enables you to control a larger amount of the underlying asset than you could with just your own capital.

Leveraged yield farming increases both your profit potential and exposure to the underlying asset. If the price of the underlying asset decreases, your position could get liquidated. You’ve got valid reasons to get excited about leveraged yield farming—especially on Marginly—but first, you need the lowdown on how it works on Marginly and to understand both the benefits and risks.

Marginly reuses its battle-tested tech for leveraged farming

You might be surprised—but Marginly uses exactly the same tech rails for leveraged yield farming as it’s been used for margin trading on Arbitrum since December 2023. Marginly smart contracts have processed over $6 million in trading volume over the past six months with around $1 million in Total Value Locked.

Marginly’s technology is already tried and tested and has undergone two audits by Quantstamp—proving its safety and efficiency. The tech was initially designed for leveraged trading of various long-tail assets; that’s why it perfectly serves niche leveraged yield farming use cases that remain inaccessible to our competitors. Getting leverage on Pendle Principal Tokens (PTs) is a prime example.

How it works

Let’s dive a bit deeper into how exactly leveraged yield farming on Marginly works.

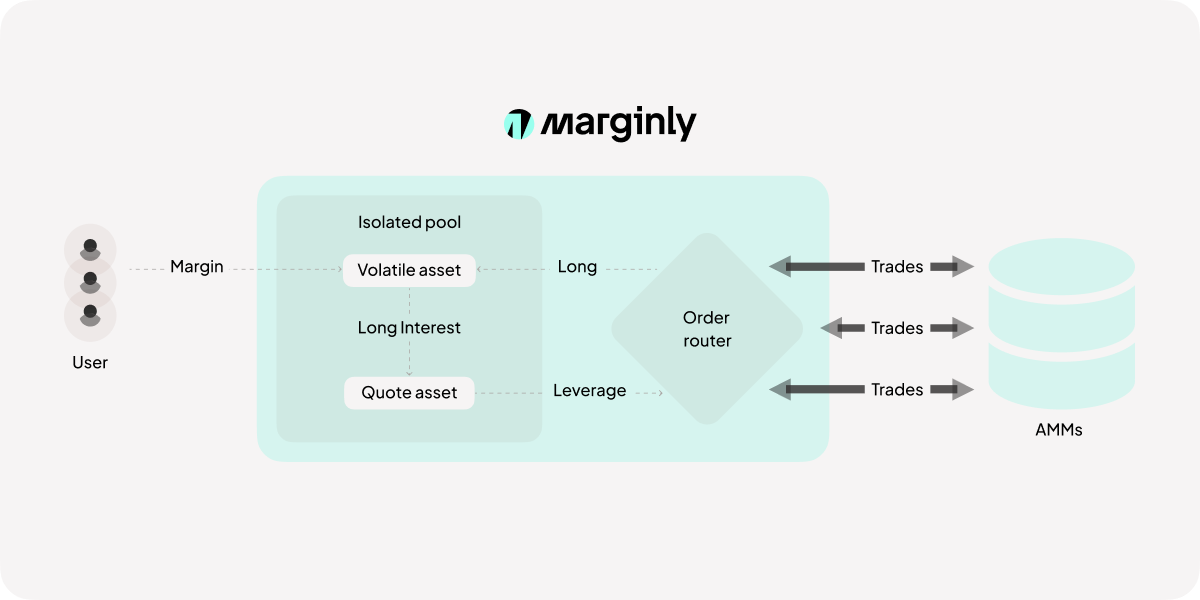

Marginly acts as a combination of single-sided lending pools connected with multiple DEXs via its trade router. The user journey starts with depositing collateral, which is used as margin, into Marginly smart contracts and specifying your desired leverage.

Then the Marginly protocol pulls out a quote asset in the amount of the leverage specified and that asset gets swapped for the target asset through connected DEXs. The proceeds of this trade, combined with the initial user margin, represent the user’s leveraged position. The whole process is depicted here—

Now imagine that the target asset is interest-bearing. The user’s leveraged position starts earning yield—both on the initial collateral and on the leveraged position. If the yield exceeds the ETH or stablecoin borrow rate on Marginly, users can earn with leverage.

Marginly funnels the majority of yield accrued on the leveraged position to liquidity providers who deposited ETH or stablecoins in the pools. The remaining yield goes to farmers, who effectively earn a standard yield on their collateral plus leverage times this remaining APY—a substantial APY boost in most cases.

The benefits of leveraged yield farming on Marginly

Why farm leveraged yield with Marginly? Plenty of leverage, safety-first protocol design, and a friendly user experience are what we’re dishing up.

High APY potential

Farmers can earn potentially eye-popping APYs by getting abundant leverage from Marginly liquidity pools to farm yield-bearing tokens.

Diversified use cases

Modular architecture and isolated liquidity pools, combined with oracle compatibility, are enabling Marginly to innovate on many new leveraged yield farming use cases.

Isolated liquidity pools

Marginly liquidity pools are entirely isolated to minimize your exposure to risk.

Double-audited smart contracts

The cybersecurity experts at Quantstamp audit all the Marginly smart contracts—twice.

100% decentralized

Marginly’s platform is non-custodial and doesn’t rely on off-chain information, making it 100% decentralized.

Airdrop eligibility

Start farming on Marginly before the platform’s native token airdrop to earn Sparks (read: points) that make you eligible for the airdrop.

1-click farming

Start farming leveraged yield in one click! Exceptional UX dramatically simplifies the entire yield farming experience for Marginly users.

The three key risks

Leveraged yield farming is risky. Because you’re using leverage, because liquidity isn’t guaranteed, and because interest rates change. Let’s explore each of these risks and how Marginly uses protocol design for risk mitigation 👇

- Liquidation risk. Absolutely the biggest risk—leverage and price volatility increase the chance of your position getting liquidated. Marginly uses time-weighted average prices (TWAPs) to smooth the magnitude of price volatility and empower farmers to de-leverage as needed.

- Liquidity risk. Both Marginly liquidity pools and external liquidity pools can suffer losses of liquidity. Marginly aims to minimize this risk by placing caps on its own pools’ borrowings relative to the liquidity in external pools with which Marginly interacts.

- Interest rate risk. Interest rates for borrowers fluctuate based on demand while yield-bearing assets typically only provide guaranteed returns if held until maturity. Marginly aims to ensure that its interest rates stay consistently below expected APYs, so farmers are guaranteed to earn a positive interest spread with leverage.

Be part of the Marginly community

You’re not just marginally important to Marginly—you’re what makes Marginly. Community is what brings farmers together, just like in the olden days 👨🌾

Wanna get involved? Do you aspire to earn so many points that you’re on the leaderboard for Sparks? Marginly’s Discord is where it gets lively, and you can also find us on X. That’s where we shout at each other (just kidding!) about all things leveraged yield farming, liquidity pools, airdrops, and Sparks.